Checking that benefits you.

Apply online in as few as five minutes!

Apply by phone!

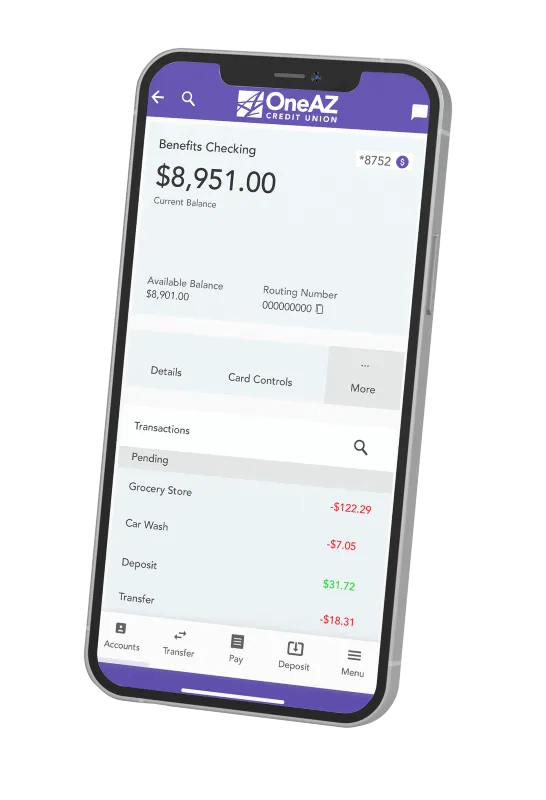

Benefits Checking1

Your checking account is more than just a place to put your money. As your daily spending account, it should pack some serious power. That’s where OneAZ’s new Benefits Checking comes in.

- Exclusive 0.25% APR discount on auto and RV loans

- Access to tri-bureau credit monitoring with alerts2

- Identity theft restoration services

- Access to dark web monitoring with alerts2

- Just $5/month for checking that benefits you

Get Benefits Checking today!

Visit a Branch

Visit one of our 20 branches across Arizona to open a new account, apply for a loan or credit card, and more. We recommend scheduling an appointment prior to your visit!

Find an ATM

With your OneAZ Visa® Debit Card, you have access to 470 CULIANCE Network ATMs in Arizona and 41,343 across the nation.

Why Choose OneAZ?

Our credit union member benefits include:

At OneAZ, our mission is to truly improve the lives of our members, our associates and the communities we serve. By becoming a member, you’re joining a credit union that cares about your future – we are here to help you achieve your financial goals. We put you first by providing you with competitive rates, low fees and the personalized service you deserve.

- You’re a Member, not a number. Your membership is your ownership stake in OneAZ Credit Union. That means we’re accountable to you, not investors or stockholders. You have a voice in how your credit union operates and get to vote for our Board of Directors.

- Our profits are your savings. As a not-for-profit, we return our earnings to you in the form of lower interest rates, lower fees and better banking technology. Our team only cares about providing you with products and services that will benefit your financial well-being.

- We keep it local. Banking at a local credit union like OneAZ keeps your money in Arizona. We’re committed to strengthening Arizona’s economy by providing affordable home and auto loans, empowering local entrepreneurs and small businesses, and supporting our members as they achieve their financial goals.

- We invest in your community. We build stronger communities by providing support to nonprofits working in neighborhoods where our members live and work. The OneAZ Community Foundation uplifts the lives of Arizonans in need by awarding dozens of grants each year to local organizations across the state.

1 MONITORING SERVICES ARE PROVIDED TO THE PRIMARY ACCOUNT HOLDER ON AN ENTITLED BASIS AND REQUIRE CONSUMER ACTIVATION. For additional details about the services, including terms, conditions, and limitations, please visit oneazcu.nxgstrategies.com.

Age Restriction: Eligible age for this product is 18 years of age or older.