Auto Loans

Drive your dream car NOW with rates as low as 5.19% APR.1

Apply Now

An auto loan to meet your budget.

-

New Auto - rates as low as 4.94% APR1 for 48 months

-

New Auto - rates as low as 5.14% APR1 for 60 months

No payment for the first 90 days of your loan2

Apply anytime.

We're here for you 24/7. Apply by phone after hours and on weekends.

New Auto Loans

- Rates as low as 5.19% APR1 available for 48-month terms

- Rates as low as 5.39% APR1 available for 60-month terms (for up to 84-month terms, click here)

- 2023 and newer vehicles are eligible1 (For older vehicles, click here)

- No payment for first 90 days2

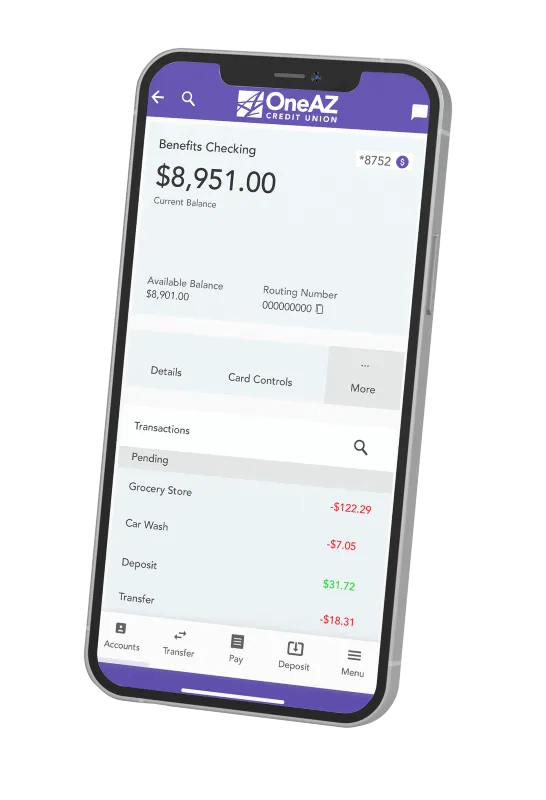

- Rates displayed include a 0.25% discount for having a Benefits Checking account

- Pay online from any bank

Used Auto Loans

- Rates as low as 5.39% APR3 for 48-month terms

- Rates as low as 5.59% APR3 for 60-month terms

- For up to 84-month terms, click here

- Rates displayed include a 0.25% discount for having a

- Benefits Checking account

- No payment for first 90 days2

- No penalty for paying early

- Apply and close your loan online

- Free CARFAX report upon request with application submission

Visit a Branch

Visit one of our 20 branches across Arizona to open a new account, apply for a loan or credit card, and more. We recommend scheduling an appointment prior to your visit!

Need more information?

Chat with a loan expert about your needs.

Call or email anytime.

See what OneAZ members are saying about our auto loans!

OneAZ Credit Union is not responsible for the content on the ReviewTrackers and Facebook websites.

Calculate your monthly auto payment using the free calculator below.

Calculators are for informational purposes only. All loans are subject to credit and income approval.

“As longtime OneAZ members, we have found our home when it comes to banking. OneAZ Credit Union knows us, they know our kids, and they are a part of our community."

APR = Annual Percentage Rate. This offer is subject to credit qualification, including verification of income, employment status, current debt obligations and other factors indicating your ability to repay the loan offered. Additional documentation will be required. Rates subject to change without notice. Click here for membership eligibility.

Rates as of July 1, 2025.

1 APR = Annual Percentage Rate. New Auto Loans are 2024 and newer vehicles, in which the equitable or legal title has not been transferred to an ultimate purchaser. Term of up to 48 months; with an APR of 4.94 % and estimated monthly payment of $23.00 per $1,000.00 borrowed. Term of up to 60 months; with an APR of 5.14 % and estimated monthly payment of $18.94 per $1,000.00 borrowed. Other finance options available. Taxes and fees are not included. The rate may vary depending on each individuals’ credit qualifications, loan term and collateral. Loans through dealers do not qualify for promotional rate. Rates include a 0.25% discount for having a Benefits Checking account. Visit our Checking page for more information. Membership qualifications apply. For membership eligibility, visit our Membership page.

1 90 Days No Payment option will extend your loan by three (3) months, and finance charges will accrue on unpaid principal. This offer does not apply to refinancing existing OneAZ loans, Credit Flex, or Indirect loans.

1 APR = Annual Percentage Rate. Used vehicles must be 15 years old or less to qualify for a loan. Term of up to 48 months; with an APR of 5.14 % and estimated monthly payment of $23.09 per $1,000.00 borrowed. Term of up to 60 months; with an APR of 5.34 % and estimated monthly payment of $19.03 per $1,000.00 borrowed. Other finance options available. Taxes and fees are not included. The rate may vary depending on each individuals’ credit qualifications, loan term and collateral. Other terms and conditions may apply. Loans through dealers do not qualify for promotional rate. Rates include a 0.25% discount for having a Benefits Checking account. Visit our Checking page for more information. Membership qualifications apply. For membership eligibility, visit our Membership page.