Maximize your home’s value.

Life is unpredictable. Your home’s equity can be a superpower to help you achieve financial goals or conquer pivotal moments. Our streamlined application process makes accessing funds fast and effortless. Leverage your home's equity with an affordable Home Equity Line of Credit (HELOC) from OneAZ.

What is a Home Equity Line of Credit?

A home equity line of credit (HELOC) allows you, as a homeowner, to borrow money by using the equity in your home as collateral. With a revolving line of credit, you can draw money as you need it. If you need flexibility and plan to use the funds periodically over time, a HELOC is a great option for you.

Your loan can help you:

- Consolidate debt

- Renovate your home

- Pay off student loan debt

- Cover unforeseen expenses

Benefits of a HELOC from OneAZ

-

Flexibility in Loan Amount:

We offer loans ranging from $10,000 - $200,000

-

Waived Closing Costs:

Save money upfront and lessen the financial burden.

-

10-Year Draw Period:

This extended timeframe to use your funds offers convenience and peace of mind.

-

Borrow as Needed:

You’re in control of your finances when you can withdraw funds when the expenses or opportunities arise.

-

HELOC Calculator

Estimate the potential HELOC limit you could be approved for using a mortgage total, unpaid balance, and Loan to Value (LTV) with our HELOC calculator.

-

Already Submitted an Application?

Check the status by clicking the button below!

-

Home Equity Checklist

Review what documents you need to apply.

-

Fixed Home Equity Loan

Is a fixed rate home equity loan a better option for you?

Home Equity Resources

At OneAZ, we want you to have the tools and the knowledge to make confident, smart decisions about your finances.

What is a Home Equity Line of Credit (HELOC)?

What is a HELOC? This guide covers how to use a HELOC to tap into your home's equity for things like home improvements or consolidating debt.

Keep ReadingHome Remodel on Any Budget

Whether you’re starting small with a kitchen refresh or overhauling your entire house, check out these tips for making your home great on any budget.

Keep ReadingHow Does a Home Equity Loan Work?

A home equity loan is a lump-sum installment loan guaranteed by the equity in your home.

Keep Reading![]()

Need More Information?

Chat with a loan expert about your needs. Call or email anytime.

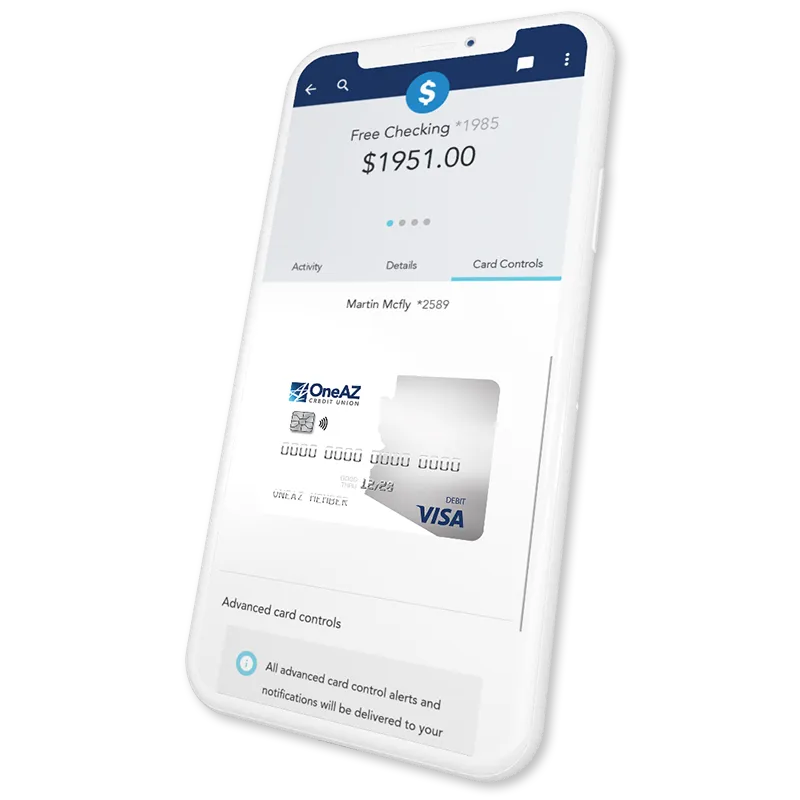

Do it all with the OneAZ Mobile Banking app.

Deposit checks

Transfer funds

Pay your bills

Chat with an associate

![]()

Locate an ATM

Download the OneAZ Mobile Banking app

APR = Annual Percentage Rate.

Rates as of July 1, 2025.

* Rates and terms are based on your credit worthiness. The rate may range from 8.25% to 11.25% based on loan amount, CLTV and applicant's credit. The fully indexed corresponding APR may range from 8.25% to 11.25%. OneAZ may pay third party fees on your behalf, in which case these will be subject to a recapture fee of $500 if loan is paid off and closed within 36 months. No $75 annual inactivity fee with balance and activity. Index (Prime Rate) is published in the Wall Street Journal following an FOMC Announcement as/when applicable or as of the 15th of each month. Variable Rate Provision: To determine the APR, we add a margin to the value of the index and round up to the nearest 0.25%. Floor Rate: 4.50%, Lifetime cap: 18.00%. Min. Payment: You will be required to make payments during draw period (10 years) and repayment period (up to 15 years).

Conditions apply. Rates and terms subject to change at any time.

Eligible Properties: Single Family Residences, PUDs (Planned Unit Development), Owned Occupied Duplexes.

Ineligible Properties: Condos, Manufactured Homes, Rental Properties, Second Homes, Triplex/Fourplex Multi-Unit Properties, Investment Properties, Out of State Properties, Commercial