How to Set Up Direct Deposit

Many employers have payroll systems that allow you to enter your checking or savings account(s) information directly into their software. Once your checking or savings account(s) information is accepted by your employer, it may take up to two payroll cycles to see direct deposit take effect.

If your employer does not have this process, you can use our Direct Deposit form.

- Download our Direct Deposit form.

- Fill in account information. What you'll need:

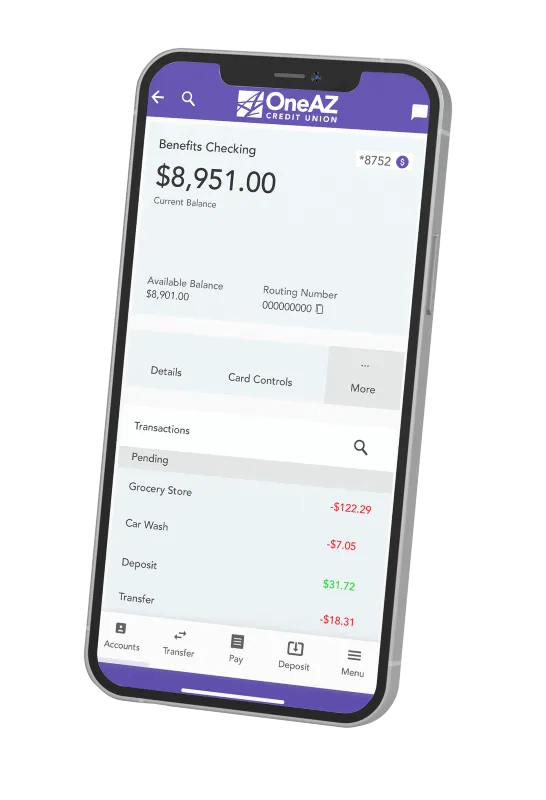

- Your OneAZ Account Number: You can find it in the OneAZ Mobile Banking app, online or on your latest statement.

- OneAZ's routing number: 322172496.

- OneAZ's address: OneAZ Credit Union 2355 W. Pinnacle Peak Rd. Phoenix, AZ 85027

- Confirm deposit amount (your full check amount or a portion of your paycheck).

- Attach a voided check. Your employer may require a voided check.

Download the direct deposit request form to take to your employer.

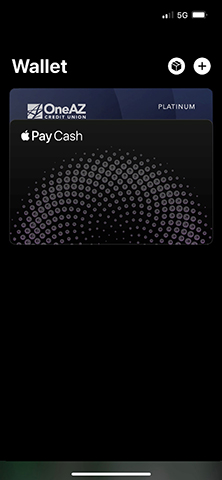

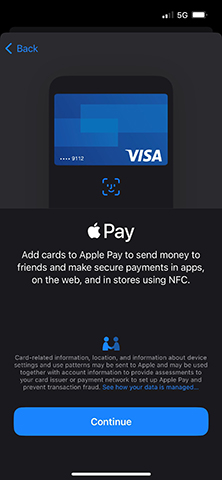

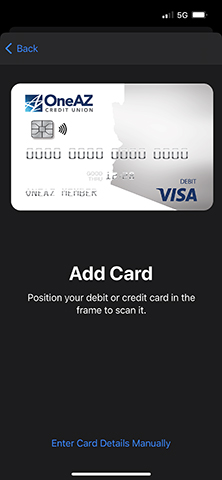

How to Add Your OneAZ Debit Card to Apple, Google or Samsung Pay

To add a OneAZ credit card to your digital wallet complete the following:

For more information visit:

![]()

Paying with a Digital Wallet (Apple, Google, or Samsung Pay)

Digital Wallet payments are accepted at several types of settings, including retail stores, restaurants, gas stations, hotels, entertainment venues. You can also use your digital wallet within many of your preferred online apps!

- Look for your preferred digital wallet icon near checkout, indicating that digital payment is accepted.

- Open your mobile wallet app and hold your device near the card reader when it’s time to pay.

- Your phone may ask you to authorize your payment with its built-in fingerprint scanner or facial recognition.

Your payment is complete—it’s that easy!

If you experience enrollment or verification issues, please call our business partner PSCU at 855.553.4291, available 24/7.

How to Order Checks

- In Online Banking, select the OneAZ account you'd like to order checks for from the left pane.

- Select Order Checks.

- Choose the style you like and enter your account information in the prompts. You’ll have an opportunity to view an image of your checks along with the price before checking out.

- Add the checks to your cart then click on your shopping cart to proceed with checkout. The purchase will be deducted from your OneAZ checking account.

Checking Account FAQs

You have the option to receive eStatements or paper statements. If you are not enrolled in Online and Mobile Banking, you will default to paper statements.

You have two options for transferring money to another financial institution. The first option is Make A Transfer in the dark blue ribbon. Then, select New Transfer from the left pane.

If the account you would like to transfer to is not in the drop-down menu, select Add an External Account. Follow the prompts to add the account you would like to transfer to and select Submit

Once the account is available in your drop-down menu, you can schedule automatic transfers and complete one-time transfers.

Overdraft Source allows you to pull funds from another account at OneAZ when your checking account does not have enough funds to complete a transaction. You can link a Savings, Personal Line of Credit, or Home Equity Line of Credit to your checking account.

When funds are not available in your checking account, OneAZ will use funds from the Overdraft Source. If funds are available in the Overdraft Source, OneAZ will complete the payment.

Learn more about signing up for Overdraft Source here.

A Travel Notification is required to be placed on file with OneAZ when you know you will be using your debit card outside of Arizona. Submitting a Travel Notification will help the OneAZ fraud team make informed decisions in the event your card is flagged for fraud.

To submit a Travel Notice in Online Banking, select the three dots on the dark blue navigation bar. Select Travel Notice and select the card you would like to submit the notice for.

Complete the requested information and select Submit. If you will be traveling to more than one destination, it is good practice in the Notes Section to list each city you anticipate using your card in.

For assistance contact our Member Care Center.

OneAZ is here to help.

Need assistance with your new debit card? Log into your online bank account and send us a secure message or chat. You can also call the Member Care Center at 844.663.2928 Monday through Friday from 8am – 6pm.

![]()

Let's conquer your finances.

Whether you want to create a budget, save for a home or get started with investing, our Financial Resources Guide has articles and videos to help you make a plan and get ahead.

Bank Account Basics: The Ultimate Guide to Managing Personal Finances

Learn the fundamentals of personal banking with details on checking accounts, savings accounts, budgeting and deciding where to manage your money.

Keep ReadingBudget Worksheet (Printable)

This free budgeting worksheet with steps on how to use it will help you create a budget and hit your financial goals.

Keep ReadingHow to Create a Budget in 7 Simple Steps

These in-depth tips will help you create a budget and manage your money more effectively.

Keep Reading