Great features available on all OneAZ Credit Cards:

See if you're pre-qualified for a credit card without impacting your credit score.

Visa State Forty Eight

Show your Arizona pride and get rewards every time you swipe!

- 0% Introductory APR1 for 12 months on your first 90 days of purchases. After the introductory period, APR may range from 16.24% to 24.00% based on applicant’s credit.

- Select your reward of choice: cash back, travel, gift cards, merchandise or charitable donations.

- Receive double reward points for balance transfers in the first 90 days.2

- Earn 5,000 bonus points after your first purchase.2

- No annual fee

Visa Choice Rewards

Reward yourself today with points on every dollar you spend.3

- 0% Introductory APR1 for 12 months on your first 90 days of purchases. After the introductory period, APR may range from 15.24% to 24.00% based on applicant’s credit.

- Select your reward of choice: cash back, travel, gift cards, merchandise or charitable donations.

- Receive double reward points for balance transfers in the first 90 days.2

- Earn 5,000 points after your first monetary transaction.2

- No annual fee

Visa Signature

The best of both worlds with a low APR and cash back.

- APR may range from 15.24% to 24.00% based on applicant’s credit.

- 1.50% cash back on qualifying purchases.3 Redeem for statement credit or deposit into your OneAZ checking account.

- Extended warranty protection

- Travel-related benefits available for card holders

- No annual fee

Visa Platinum

A straightforward card with low rates.

- APR may range from 13.24% to 22.00% based on applicant’s credit.

- Minimum credit line of $2,500

- Cash advances at ATMs

- Roadside dispatch program available for cardholders

- No annual fee

Apply anytime.

We're here for you 24/7. Apply by phone after hours and on weekends.

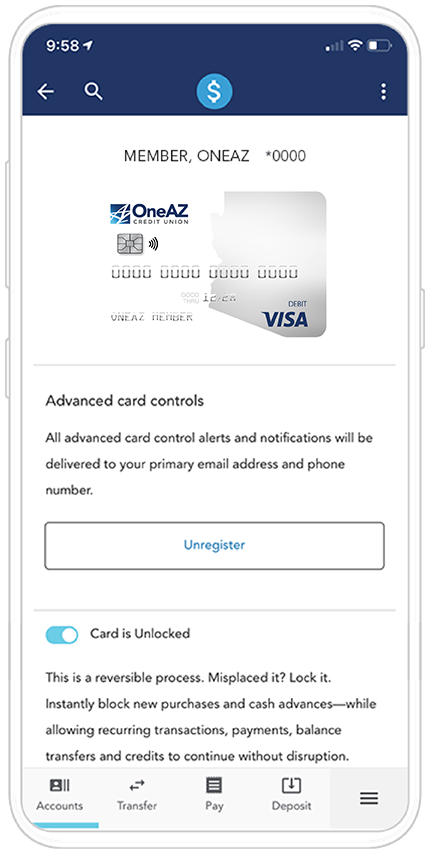

Advanced card controls.

Take control of your credit card using the OneAZ Mobile Banking app.

- Instantly lock and unlock your credit cards

- Set travel notices for planned trips

- Block international in-store transactions

- Enable merchant controls

- Receive custom alerts

Why Choose OneAZ?

At OneAZ, our mission is to truly improve the lives of our members, our associates and the communities we serve. By becoming a member, you’re joining a credit union that cares about your future – we are here to help you achieve your financial goals. We put you first by providing you with competitive rates, low fees and the personalized service you deserve.

- You’re a Member, not a number. Your membership is your ownership stake in OneAZ Credit Union. That means we’re accountable to you, not investors or stockholders. You have a voice in how your credit union operates and get to vote for our Board of Directors.

- Our profits are your savings. As a not-for-profit, we return our earnings to you in the form of lower interest rates, lower fees and better banking technology. Our team only cares about providing you with products and services that will benefit your financial well-being.

- We keep it local. Banking at a local credit union like OneAZ keeps your money in Arizona. We’re committed to strengthening Arizona’s economy by providing affordable home and auto loans, empowering local entrepreneurs and small businesses, and supporting our members as they achieve their financial goals.

- We invest in your community. We build stronger communities by providing support to nonprofits working in neighborhoods where our members live and work. The OneAZ Community Foundation uplifts the lives of Arizonans in need by awarding dozens of grants each year to local organizations across the state.

Rates as of July 1, 2025.

*The campaign will be active from 12:00:00 a.m. Arizona time on November 1st and ends at 11:59:59 p.m. on November 30th, 2024. Participants must be a legal resident of Arizona and 18 or older to participate. To qualify, participants must open a OneAZ Signature Credit Card during the campaign period, activate the card within 30 days after it is funded, and spend a minimum of $2,000 on eligible purchases within the first 90 days of card activation. For information about rates, fees other costs and benefits associated with the use of this card, go to our website at https://www.oneazcu.com/personal/credit-cards/visa-signature/.

Eligible purchases are defined as authorized charges made with the OneAZ Signature Credit Card for goods and services. Excluded transactions include balance transfers, cash advances, convenience checks, gift card purchases, sports betting sites or other online gaming transactions, wire transfers, money transfers, traveler’s checks, money orders, certified checks, incidental charges, and fees (such as voluntary payment protection costs, finance charges, returned check fees, service charges, unauthorized or fraudulent transactions, and ATM fees). Purchases made when the member account(s) are not in good standing are also excluded.

The eligibility of transactions is at OneAZ's sole discretion. Qualified participants who meet the criteria listed above will receive a $200 credit to their Primary Share Savings Account within 60 days of meeting the qualifying spend. Other terms and conditions may apply. The member account(s) must be open and in good standing during the promotional period and at the time of fulfillment. OneAZ Credit Union reserves the right to modify or cancel this promotion at its discretion at any time. Member eligibility for this offer is determined solely by OneAZ Credit Union. Membership eligibility requirements apply.

All loans subject to credit and income approval.

1 See table below for details

| INTEREST RATES AND INTEREST CHARGES | |

| Annual Percentage Rate (APR) for Purchases | 0.00% for Visa Choice Rewards Credit Card and State Forty Eight Credit Card for 12 months on all purchases made within the

first 90 days of open date. After that, your APR will be 15.24% - 24.00% for Visa Choice Rewards Credit Card and 16.24% - 24.00% for State Forty Eight Credit Card, based on your creditworthiness and will vary with the market based on the Prime Rate. Your APR will be 13.24% - 22.00% for Visa Platinum Credit Card and 15.24% - 24.00% for Visa Signature Credit Card, based on your creditworthiness and will vary with the market based on the Prime Rate. |

|---|---|

| APR for Balance Transfers | Balance Transfer APR: 15.24% - 24.00% for Visa Choice Rewards Credit Card, 13.24% - 22.00% for Visa Platinum Credit Card, 15.24% - 24.00% for Visa Signature Credit Card and 16.24% - 24.00% for State Forty Eight Credit Card, based on your creditworthiness and will vary with the market based on the Prime Rate. |

| APR for Cash Advances | Cash Advance APR: 15.24% - 24.00% for Visa Choice Rewards Credit Card, 13.24% - 22.00% for Visa Platinum Credit Card, 15.24% - 24.00% for Visa Signature Credit Card and 16.24% - 24.00% for State Forty Eight Credit Card, based on your creditworthiness and will vary with the market based on the Prime Rate. |

| Penalty APR and When It Applies | 24.00% - This APR may be applied to your account

if:

If your APR is increased for any of these reasons, the penalty APR will apply until you make six consecutive minimum payments when due. |

| How to Avoid Paying Interest on Purchases | Your due date is at least 25 days after the close of each billing cycle. We will not charge any interest on the portion of the purchases balance that you pay by the due date each month. |

| Minimum Finance Charge | If you are charged interest, the charge will be no less than $1.00. |

| For Credit Card Tips from the Consumer Financial Protection Bureau | To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at https://www.consumerfinance.gov/learnmore/. |

| FEES | |

| Annual Fee | None |

| Transaction Fees: Balance Transfer Foreign Transaction |

3% of the amount of each transaction (minimum $10.00) 1% of the US dollar amount of the foreign transaction |

| Penalty Fees: Late Payment Fee Returned Item Charge |

$25.00 $25.00 or the amount of the returned item, whichever is less |

| Other Fees: Pay by Phone |

$20.00 |

How We Will Calculate Your Balance: We use a method called “Average Daily Balance” (including new purchases). We reserve the right to amend the VISA© Credit Card Agreement as permitted by law.

Effective Date. The information about the costs of the cards described in this disclosure is accurate as of July 1 2025. This information may have changed after that date. To find out what may have changed, contact OneAZ Credit Union.

IMPORTANT DISCLOSURE FOR ACTIVE MEMBERS OF THE MILITARY AND THEIR DEPENDENTS:

Federal law provides important protections to members of the Armed Forces and their dependents relating to

extensions of consumer credit. In general, the cost of consumer credit to a member of the Armed Forces and his or

her dependent may not exceed an annual percentage rate of 36 percent. This rate must include, as applicable to the

credit transaction or account: the costs associated with credit insurance premiums or debt protection fees; fees for

ancillary products sold in connection with the credit transaction; any application fee charged (other than certain

application fees for specified credit transactions or accounts); and any participation fee charged (other than

certain participation fees for a credit card account). To receive this notice verbally, please call 1.844.663.2928 during our normal business

hours: Monday - Friday 8:00 am - 6:00 pm.

2 THINGS YOU SHOULD KNOW ABOUT THIS REWARDS PROGRAM

How are Reward Points Calculated?

Points are calculated on each individual purchase transaction and rounded [up or down] to the nearest whole dollar. The individual results are then added together, and we subtract any returns, credits, or adjustments to determine the net points earned. Points are calculated and credited daily.

How Do I Redeem My Rewards?

There are five ways you can redeem your points:

1. Travel Redemption

2. Merchandise Redemption

3. Merchant Gift Card Redemption

4. Cash Redemption

5. Donation Redemption

There is no fee to participate in the OneAZ rewards program and you are automatically enrolled when opening a OneAZ Choice Rewards Credit Card.

All point redemptions are final. Redemptions are subject to point availability and other conditions contained in the Choice Rewards Credit Card Terms and Conditions disclosure.

Disputes:

All point disputes must be made in writing and sent to:

OneAZ Credit Union

Attn: Card Services

2355 W. Pinnacle Peak Road

Phoenix, AZ 85027

You must contact us within 60 days after the error appeared on your statement. You must notify us in writing.

All decisions by OneAZ regarding point disputes are final.

When we receive your letter, we must do two things:

Within 30 days of receiving your letter, we must tell you we received your letter. We will also tell you if we have already corrected the error.

Within 90 days of receiving your letter, we must correct the error or explain to you why we believe the statement is correct.

3 1.50% rebate is not eligible on cash advances and balance transfers.