Supporting local business is more important than ever.

Get a 35% discount on all State Forty Eight apparel purchases.

Shop online with promo code ONEAZ35 upon checkout at www.statefortyeight.com.

All about AZ. That’s Onederful.

Since its humble beginnings with a single t-shirt press in 2013, State Forty Eight has exploded to become a brand that is known and loved across Arizona. Their iconic designs represent Arizonans’ pride for our local community, and they leverage their popularity to work with local businesses and nonprofits. OneAZ and State Forty Eight are proud to partner together in support of Arizona.

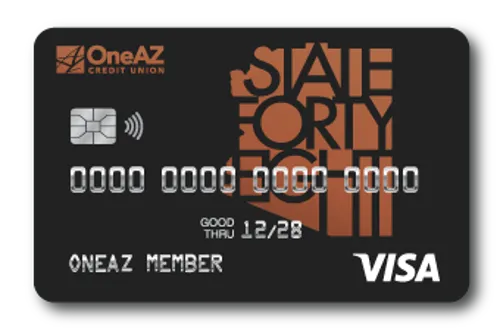

State Forty Eight Credit Card

- 0% APR1 on first 90 days of purchases for 12-months. After introductory period, APR may range from 17.24% to 24.00% based on applicant's credit.

- Rewards for every eligible purchase

- Exclusive State Forty Eight card design

Clothing for all, inspired by Arizona.

State Forty Eight has been serving up unique t-shirts, hats, decals and more since 2013, all in celebration of Arizona. What truly sets this brand apart, though, is their support of the local community. State Forty Eight partners with Arizona businesses and nonprofits to collaborate on exclusive t-shirt designs. “We genuinely care about our community and about giving back any possible way,” says co-founder Mike Spangenberg. “We want to make cool designs with a cause.”

“Working with OneAZ has been a breath of fresh air…it’s incredible to have developed so many genuine relationships with the OneAZ team members in such a short time of banking with them.”

See what other members have to say about OneAZ. See Testimonials

It's about you, not your money.

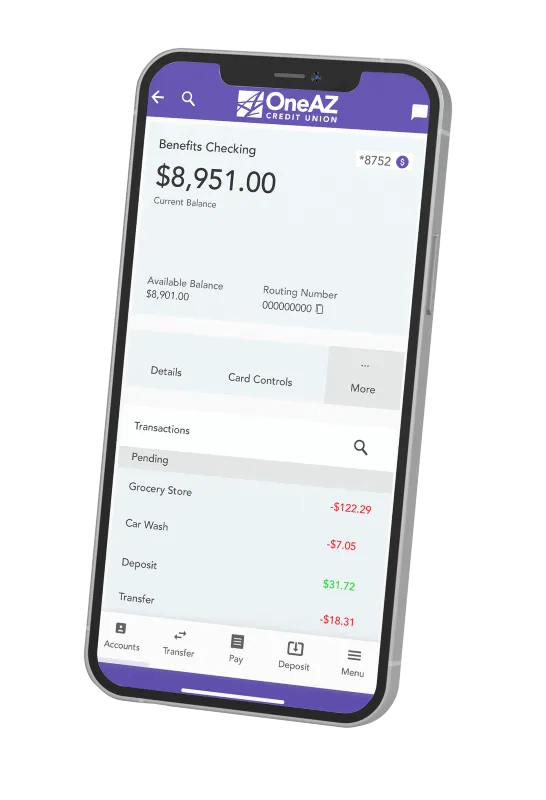

You can customize your OneAZ experience by choosing from a full suite of business and personal financial services. We offer competitive pricing and loan rates to help you meet your financial goals, plus state-of-the-art online banking and a highly rated mobile banking app so you can manage your finances wherever you are.

We keep it local.

Arizona members have been trusting OneAZ Credit Union with their finances since 1951. As a not-for-profit, we reinvest our profits in our members and the community to strengthen the Arizona economy.

We're community-focused.

OneAZ Credit Union and OneAZ Community Foundation invest in the communities we serve. Together, we help students, nonprofits and disaster victims thrive financially, because we believe when our community succeeds, we all succeed.

APR = Annual Percentage Rate.

1 All loans subject to credit and income approval. Please see table below.

| INTEREST RATES AND INTEREST CHARGES | |

| Annual Percentage Rate (APR) for Purchases | 0.00% Introductory APR for 12-Months from account opening on the first 90 days of purchases. After that, your APR will be 16.24% - 24.00%, based on your creditworthiness and will vary with the market based on the Prime Rate. |

|---|---|

| APR for Balance Transfers | Balance Transfer APR: 16.24% - 24.00%, based on your creditworthiness and will vary with the market based on the Prime Rate. |

| APR for Cash Advances | Cash Advance APR: 16.24% - 24.00%, based on your creditworthiness and will vary with the market based on the Prime Rate. |

| Penalty APR and When It Applies | 24.00% - This APR may be applied to your account if:

If your APR is increased for any of these reasons, the penalty APR will apply until you make six consecutive minimum payments when due. |

| How to Avoid Paying Interest on Purchases | Your due date is at least 25 days after the close of each billing cycle. We will not charge any interest on the portion of the purchases balance that you pay by the due date each month. |

| Minimum Finance Charge | If you are charged interest, the charge will be no less than $1.00. |

| For Credit Card Tips from the Consumer Financial Protection Bureau | To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at https://www.consumerfinance.gov/learnmore/. |

| FEES | |

| Annual Fee | None |

| Transaction Fees: Cash Advance Foreign Transaction |

3% of the cash advance transaction (minimum $10.00) 1% of the US dollar amount of the foreign transaction |

| Penalty Fees: Late Payment Fee Returned Item Charge |

$25.00 $25.00 or the amount of the returned item, whichever is less |

| Other Fees: Pay by Phone |

$20.00 |

How We Will Calculate Your Balance: We use a method called "average daily balance" (including new purchases). We reserve the right to amend the VISA© Credit Card Agreement as permitted by law.

Effective Date. The information about the costs of the card described in this disclosure is accurate as of July 1, 2025. This information may have changed after that date. To find out what may have changed, contact OneAZ Credit Union.

Loss of Introductory APR: We may end your introductory APR and apply the penalty APR if you make a payment more than 60 days late.

Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your account agreement.

These Account Disclosures for the Choice Rewards Credit Card are part of and integrated with your Credit Card Agreement and Disclosure with OneAZ Credit Union.

How are Reward Points Calculated?

Points are calculated on each individual purchase transaction and rounded [up or down] to the nearest whole dollar. The individual results are then added together and we subtract any returns, credits or adjustments to determine the net points earned. Points are calculated and credited daily.

How Do I Redeem My Rewards?

There are five ways you can redeem your points:

- Travel Redemption

- Merchandise Redemption

- Merchant Gift Card Redemption

- Cash Redemption

- Donation Redemption

There is no fee to participate in the OneAZ rewards program and you are automatically enrolled when opening a OneAZ Choice Rewards Credit Card.

All point redemptions are final. Redemptions are subject to point availability and other conditions contained in the Choice Rewards Credit Card Terms and Conditions disclosure.

Disputes:

- All point disputes must be made in writing and sent to:

OneAZ Credit Union

Attn: Card Services

2355 W. Pinnacle Peak Road

Phoenix, AZ 85027 - You must contact us within 60 days after the error appeared on your statement. You must notify us in writing

- All decisions by OneAZ regarding point disputes are final.

When we receive your letter, we must do two things:

- Within 30 days of receiving your letter, we must tell you we received your letter. We will also tell you if we have already corrected the error.

- Within 90 days of receiving your letter, we must correct the error or explain to you why we believe the statement is correct.

IMPORTANT DISCLOSURE FOR ACTIVE MEMBERS OF THE MILITARY AND THEIR DEPENDENTS:

Federal law provides important protections to members of the Armed Forces and their dependents relating to extensions of consumer credit. In general, the cost of consumer credit to a member of the Armed Forces and his or her dependent may not exceed an annual percentage rate of 36 percent. This rate must include, as applicable to the credit transaction or account: the costs associated with credit insurance premiums or debt protection fees; fees for ancillary products sold in connection with the credit transaction; any application fee charged (other than certain application fees for specified credit transactions or accounts); and any participation fee charged (other than certain participation fees for a credit card account). To receive this notice verbally, please call 1.844.663.2928 during our normal business hours: Monday - Friday 8:00 am - 6:00 pm.