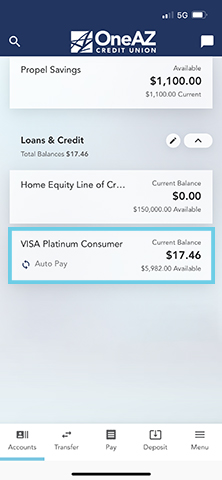

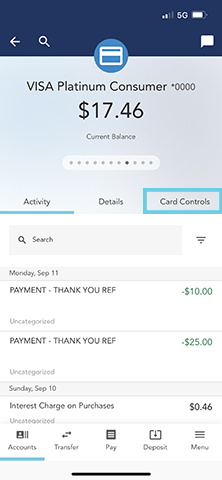

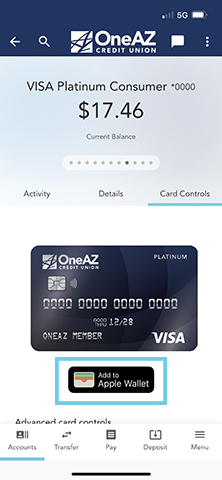

Get Your Wallet Ready

How to Add Your OneAZ Credit Card to Apple or Google Pay

To add a OneAZ credit card to your digital wallet, log in to online banking and complete the following:

Your credit card will be ready to use in your digital wallet.

For more information visit:

![]()

Paying with a Digital Wallet (Apple, Google, or Samsung Pay)

Digital Wallet payments are accepted at several types of settings, including retail stores, restaurants, gas stations, hotels, entertainment venues. You can also use your digital wallet within many of your preferred online apps!

- Look for your preferred digital wallet icon near checkout, indicating that digital payment is accepted.

- Open your mobile wallet app and hold your device near the card reader when it’s time to pay.

- Your phone may ask you to authorize your payment with its built-in fingerprint scanner or facial recognition.

Your payment is complete—it’s that easy!

If you experience enrollment or verification issues, please call our business partner PSCU at 855.553.4291, available 24/7.

How to Make Your Credit Card Payment

- Online & Mobile Banking: Once you’re logged in, select Make a Transfer then select New Transfer. On the New Transfer screen, choose the account you want to pay from, then select the credit card account you want to pay. Enter your payment details.

- Select from one-time, recurring, or ‘schedule a payment’ options.

- You may choose to pay from a OneAZ account or a non-OneAZ checking account, savings account or debit card.

- Payments may take up to three business days to post.

- If the account you would like to transfer to is not in the drop-down menu, select New External Financial Institution. Follow the prompts to add the account you would like to transfer to and select Submit.

- You may also select Pay a Loan with a Debit Card to make a one-time payment.

- Phone: Contact our Member Care Center and ask them to apply funds from your OneAZ account toward your credit card balance. Our Member Care Center can also take payments over the phone with a credit or debit card; there may be a fee associated with this service.

- In person: Visit your local OneAZ branch and work with a teller to make your payment.

Credit Card FAQs

Yes! OneAZ will send you a text message immediately following suspicious activity. You can reply to the text message to let us know if the transaction(s) in question are valid.

If you do not respond to the text message, our team will send you a series of pre-recorded phone calls to notify you of the suspicious activity. If we don’t hear from you through text or phone, an email will be sent asking you to review and provide feedback on the transaction.

Note: OneAZ will NEVER ask for personal information through text.

Before taking action to file a dispute, review the details of the charge. If the charge looks incorrect, contact the merchant first. Merchants can resolve charge errors within a few days, whereas it can sometimes take financial institutions weeks to resolve. If the merchant is unable to resolve the charge error, OneAZ can investigate on your behalf.

You can submit a credit card dispute through Online Banking. Select your OneAZ credit card from the left pane, under activity select the transaction that needs to be disputed, tell us What Happened, select Next. Enter the details needed for the dispute and select Next. Review the dispute and if everything looks good, select Submit.

If you file a credit card dispute, you will be asked to provide details about the transaction. The more details you provide, the quicker your dispute may be resolved. Investigating a dispute may take 30 to 90 days. Provisional credits for disputes can take up to 10 business days to be processed.

If you would like to begin a credit card dispute, please call us at 800.449.7728.

If you would like to report a card lost or stolen, you can create a report in Online Banking.

Select your card from the left pane and click on the three dots. Then, select Report Card Lost/Stolen.

We will ask you if any of your recent transactions look suspicious. Provide a yes or no answer and select Next. Once you are satisfied with your entry, select Submit. When you select Continue, the request is submitted for processing. Your existing card, the one being reported lost or stolen, will be immediately deactivated.

If you would like assistance, please call us at 866.820.5806. Credit cards may take 10-14 business days to arrive by mail, but you may start using your card in your digital wallet sooner. See directions above.

If you would like to obtain a new credit card, you can complete your request in Online Banking. Select the card you would like to replace from the left pane. Next, select the three dots in the dark blue navigation bar, then select Request New Card. Choose the card you would like to replace and select Continue.

Credit cards may take 10-14 business days to arrive by mail.

If you believe fraud has been detected on your credit card, report the activity to the number on the back of your card immediately. Our team of fraud experts will walk you through the steps needed to file a fraud dispute, then assign your case to a fraud specialist for review.

To create a PIN for your credit card, please call PIN NOW at 888.886.0083 from the telephone number you have on file with OneAZ.

If you would like to add a joint owner to your OneAZ Visa credit card, the individual will need to complete an application and become a member with OneAZ Credit Union.

To get started with an application, please schedule an appointment online to meet with a personal banker at your local branch , or contact our Member Care Center at 844.663.2928.

Once your online application is reviewed and processed, an account opening specialist will call to finalize account setup.

To add an authorized user to your OneAZ Visa credit card, please schedule an appointment online to meet with a personal banker at your local branch , or contact our Member Care Center at 844.663.2928.

You may also call our Virtual Team at 844.262.6805 for assistance.

For assistance, please contact our Member Care Center at 844.663.2928. They can document and submit your request for a balance transfer and ensure that the request is completed.

If you're signed into Online Banking, select the three dots on the navigation bar. Then, select Balance Transfer.

If you're signed into Mobile Banking, select Menu, then select More, then select Balance Transfer.

OneAZ completes a review every six months to determine if you qualify for an increase. If you qualify, OneAZ will automatically apply the increase.

If you would like for one of our associates to complete a manual review, please contact our Member Care Center at 844.663.2928 or schedule an appointment online to meet with a personal banker at your local branch.

If you would like to add insurance protection to your credit card, contact our Member Care Center at 844.663.2928. Our team will walk you through the information needed to submit a request.

Yes, you can use your OneAZ VISA credit card outside of the United States. There is a 1% fee on transactions completed outside of the country.

A Travel Notice is required to be placed on file with OneAZ when you know you will be using your debit or credit card outside of Arizona. Submitting a travel notice will help the OneAZ fraud team make informed decisions in the event your card is flagged for fraud.

To submit a Travel Notice in Online Banking, select the three dots on the dark blue navigation bar. Select Travel Notice and select the card you would like to submit the notice for.

Complete the requested information and select Submit. If you will be traveling to more than one destination, it is good practice in the Notes Section to list each city you anticipate using your card in.

You may have one active Travel Notice on file per OneAZ card. Do not submit a new Travel Notice until your current Travel Notice is no longer needed.

If you are not a member with OneAZ, but have a OneAZ card through a joint arrangement, please call our Member Care Center at 844.663.2928.

For assistance with a Travel Notice, please contact our Member Care Center.

OneAZ offers account alerts for OneAZ accounts, credit cards, debit cards, and Bill Pay.

In Online Banking, select the three dots in the upper right-hand corner of the page. Next, select Alerts. Select the alert you would like to add and click on the toggle button to turn the alert on/off.

When turning alerts on, complete the required information, select the delivery method for the alert (email, text or push notification), then select Save.

OneAZ is here to help.

Need assistance with your new credit card? Log into your online bank account and send us a secure message or chat. You can also call the Member Care Center at 844.663.2928 Monday through Friday from 8am – 6pm.

Conquer your credit.

Our Financial Resources Guide has everything you need to help you use your credit card wisely, build good credit, and understand how your credit score works. Check out our Credit & Debt section for more guidance.

How Does a Credit Score Really Work?

Your credit score affects loan terms and interest rates by showcasing your borrowing behavior.

Keep ReadingHow to Improve Your Credit Score in 7 Simple Steps

Start by looking over your monthly credit reports for errors, then work to catch up on overdue payments and pay down revolving credit balances each month.

Keep ReadingHow to Take Advantage of Credit Card Rewards

Take advantage of credit card rewards programs while using your card wisely, so you can build credit while earning cash back, travel miles or points.

Keep Reading