Mortgage FAQs

You have the option to receive eStatements or paper statements. If you are not enrolled in Online and Mobile Banking, you will default to paper statements.

Once you are enrolled in Online and Mobile Banking, click on the three dots in the blue navigation bar and select Documents and Statements. Select Register and let us know if this is for a Personal Account or a Business Account.

Complete the required fields and select Next. Review the Consent to Electronic Documents and select the checkbox to confirm you have read and agree to the terms outlined. Then select Finish. This will complete your eStatement enrollment.

To turn eStatements off, click on the three dots in the navigation bar, select Documents and Statements, select Settings. From here, you can select the Discontinue box and click Submit.

Use the New Member Registration guide to view step-by-step instructions.

There are multiple ways to make a payment on your OneAZ loan. Take a moment to review your options below.

-

Online & Mobile Banking: Once you’re logged in, select Make a Transfer then select New Transfer. On the New Transfer screen, choose the account you want to pay from, then select the loan account you want to pay. Enter your payment details and select from one-time, recurring, or ‘schedule a payment’ options. You may choose to pay from a OneAZ account or a non-OneAZ checking account, savings account or debit card. Payments may take up to three business days to post.

If the account you would like to transfer to is not in the drop-down menu, select New External Financial Institution. Follow the prompts to add the account you would like to transfer to and select Submit.

You may also select Pay a Loan with a Debit Card to make a one-time payment. - Telephone Banking: If you are transferring your payment from a OneAZ account, dial 844.663.2928 to use our automated payment service. You must enter your member number and have a pre-established PIN. Please see our Telephone Banking FAQs for additional support.

-

Call Us: If you have the funds available in a OneAZ account, you can contact our Member Care Center and ask them to apply these funds toward your loan. Our Member Care Center can also take payments over the phone with a credit or debit card; there may be a fee associated with this service.

Take a look at OneAZ’s Account Disclosure Rate Supplement and Schedule of Fees and Charges to view current fees and rates. - In-person: Visit us at your local OneAZ branch and work with a teller to make your payment.

-

Mail: Send a check to our corporate office at the address below. Your name and address should be on the check, and the memo line should contain your loan number and payment due date.

OneAZ Corporate Office

ATTN: Deposit Operations

2355 W. Pinnacle Peak Rd.

Phoenix, AZ 85027

You can view your mortgage loan details on your monthly statement or online.

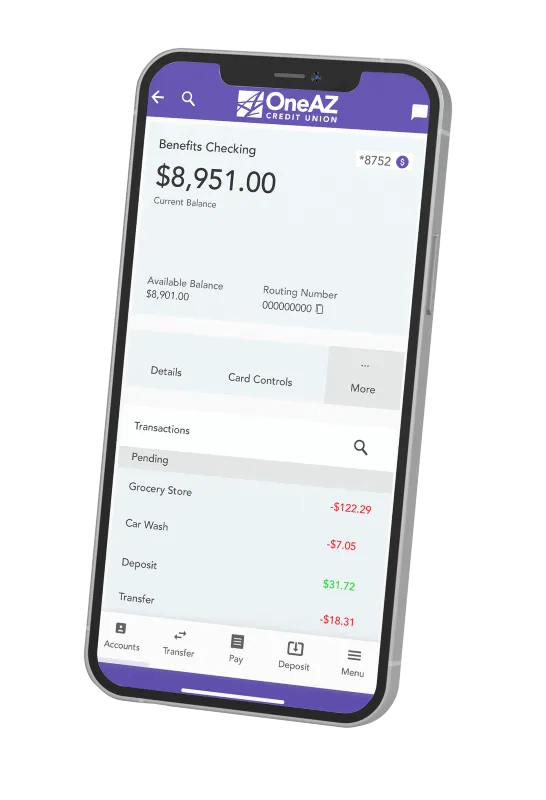

If you’re signed into Online or Mobile Banking, select the loan account from the left pane. A screen will appear that shows your amount due, payment due date and more.

We Can Help

Our team of experts is standing by to help you achieve your financial goals.

To open a new account, apply for a loan or get answers to your questions, contact our Virtual Team or make an appointment at your local OneAZ branch today.

Visit a Branch

Visit one of our 20 branches across Arizona to open a new account, apply for a loan or credit card, and more. We recommend scheduling an appointment prior to your visit!

Find an ATM

With your OneAZ Visa® Debit Card, you have access to 470 CULIANCE Network ATMs in Arizona and 41,343 across the nation.

Why Choose OneAZ?

At OneAZ, our mission is to truly improve the lives of our members, our associates and the communities we serve. By becoming a member, you’re joining a credit union that cares about your future – we are here to help you achieve your financial goals. We put you first by providing you with competitive rates, low fees and the personalized service you deserve.

- You’re a Member, not a number. Your membership is your ownership stake in OneAZ Credit Union. That means we’re accountable to you, not investors or stockholders. You have a voice in how your credit union operates and get to vote for our Board of Directors.

- Our profits are your savings. As a not-for-profit, we return our earnings to you in the form of lower interest rates, lower fees and better banking technology. Our team only cares about providing you with products and services that will benefit your financial well-being.

- We keep it local. Banking at a local credit union like OneAZ keeps your money in Arizona. We’re committed to strengthening Arizona’s economy by providing affordable home and auto loans, empowering local entrepreneurs and small businesses, and supporting our members as they achieve their financial goals.

- We invest in your community. We build stronger communities by providing support to nonprofits working in neighborhoods where our members live and work. The OneAZ Community Foundation uplifts the lives of Arizonans in need by awarding dozens of grants each year to local organizations across the state.