Financial solutions for all Lumberjacks

$100 in your pocket.

Open your OneAZ Free Checking account1 and receive a $100 deposit.2

Apply in-person or call and mention Student Checking. Be sure to bring your student ID.

Visit a Branch

Visit one of our 20 branches across Arizona to open a new account, apply for a loan or credit card, and more. We recommend scheduling an appointment prior to your visit!

Vintage Flagstaff.

OneAZ Credit Union has been serving the Flagstaff area since 1970. With a branch on Beaver Street just steps away from campus, we know what it means to live the Lumberjack life!

Money Management for Arizona College Students

OneAZ is here to give you the run-down of what you need to know to manage your funds so you can focus more on studying than on worrying about expenses.

Keep ReadingHow to Save Money in College

You can avoid being a starving student by taking a few conscious steps to save money while having an excellent college experience.

Keep Reading5 Ways to Keep Your Money Local

Supporting Arizona businesses means your money stays local, through taxes, investments and more. That means that your hard-earned money, once spent, continues to work for you and improve the economy.

Keep ReadingWhy Choose OneAZ

Data rates apply.

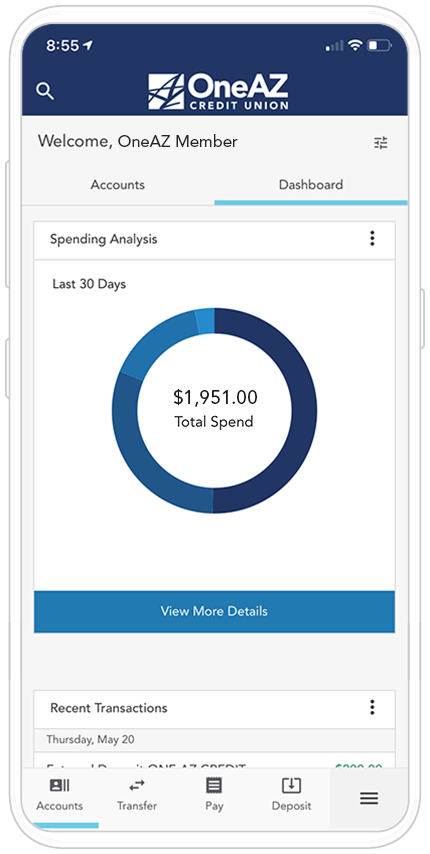

Now your bank is as mobile as you are.

- Set Travel Notices

- Card Controls

- Financial Goal Setting

- Seamless on All Devices

- Alerts

- Check Ordering

Compatible with:

Insured by NCUA

1 Checking is free; however, fees incurred—such as a stop payment or NSF fee—will apply. For complete terms and conditions, refer to the published Membership Account Agreement and Schedule of Fees and Charges.

2 Student Offer: Students can earn a $100 cash bonus by opening a new Checking account and using their OneAZ debit card to make 5 qualifying transactions within the first 60 days of account opening to qualify. The debit card purchases must post and clear the account to count towards the spend requirements. This offer is available to new members only. Applicants must meet OneAZ Credit Union eligibility requirements and must be enrolled in school full time. Requirements may be found at OneAZcu.com/membership. Offer is not available to existing OneAZ Credit Union members or those who have closed their membership within the past 12 months. Members under the age of 18 are not eligible for the $100 bonus.

Additional Program Guidelines/Restrictions: The promotional period is from 10/3/2022 through 12/31/2022. All account applications are subject to approval. A Checking accounts must be open and in good standing with a balance greater than $0.00 to be eligible for the cash bonus. Offers are limited to one per primary member per year. OneAZ Credit Union reserves the right to modify or discontinue this offer at any time. We also reserve the right to rescind any cash bonus paid if there is a violation of the terms, requirements and/or promotional guidelines of these offers. The cash bonus earned will be reported on IRS Form 1099-INT (or Form 1042-S, if applicable). This offer is not transferable and cannot be combined with any other promotions. Membership at OneAZ is required by opening a minimum $5.00 Share Savings account. Account Closure: If the checking account is closed by the member or by OneAZ Credit Union within 6 months after opening, we will deduct the bonus amount from that account at closing