Key Takeaways

- Inflation can stem from either cost-push or demand-pull factors, with rising production costs or excessive consumer demand driving price increases respectively.

- By monitoring economic indicators and adjusting budgets, you can navigate inflationary pressures and protect your purchasing power.

- Sticking to a budget, saving money, and managing debt wisely are ways you can mitigate the impact of inflation and maintain financial stability.

Keeping a pulse on inflation trends and adapting your budget accordingly can help you protect your finances.

Do you ever look back in time and wonder why things were so much cheaper years ago? A loaf of bread cost six cents in 1914, gas was 10 cents a gallon in 1939, an average house sold for $20,000 in 1964 and a new car cost only $12,000 in 1989.

So, what happened?

The answer is inflation. Here we’ll discuss the types of inflation, how inflation is measured and what you can do as a consumer to navigate rising prices.

How Does Inflation Work?

- Inflation is the increase in the price of goods and services over time.

- As you may have noticed, inflation leads to higher prices for goods and services.

- Which results in lower purchasing power. This is just a fancy way of saying your dollar doesn’t go as far today as it used to.

Types of Inflation

Why do prices continue to go up over time and what causes inflation? We've seen a combination of cost-push inflation, demand-pull inflation, and inflation as a result of more money being injected into the economy during the COVID-19 pandemic.

Let’s start with the different types of inflation.

What is Cost-Push Inflation?

The first type of inflation we see is called cost-push inflation.

This happens when the cost of goods and services to a business increases and the business passes those higher costs onto their customers.

One of the most famous examples of cost-push inflation is the oil embargo of 1973.

During the oil embargo, OPEC stopped selling oil to the United States. This caused the price of fuel to skyrocket 400% and as a result, industries that relied on oil and gas were forced to raise their prices to stay afloat.

Average Cost for a Gallon of Gas

Although there isn’t another oil embargo happening today, the average cost for a gallon of gas has gone from $2.82 per gallon in March 2021 to $4.68 per gallon for March 2022. This 66% increase in gas prices not only is felt by you and me at the pump, but this increase in gas prices is also felt by businesses.

Demand-Pull Inflation

The more common type of inflation we see is called demand-pull inflation.

This happens when supply cannot keep up with an increase in the demand for a product or service.

A better way to think about it is this: more people want stuff and there isn’t enough stuff to go around, so the price of whatever stuff is available goes up.

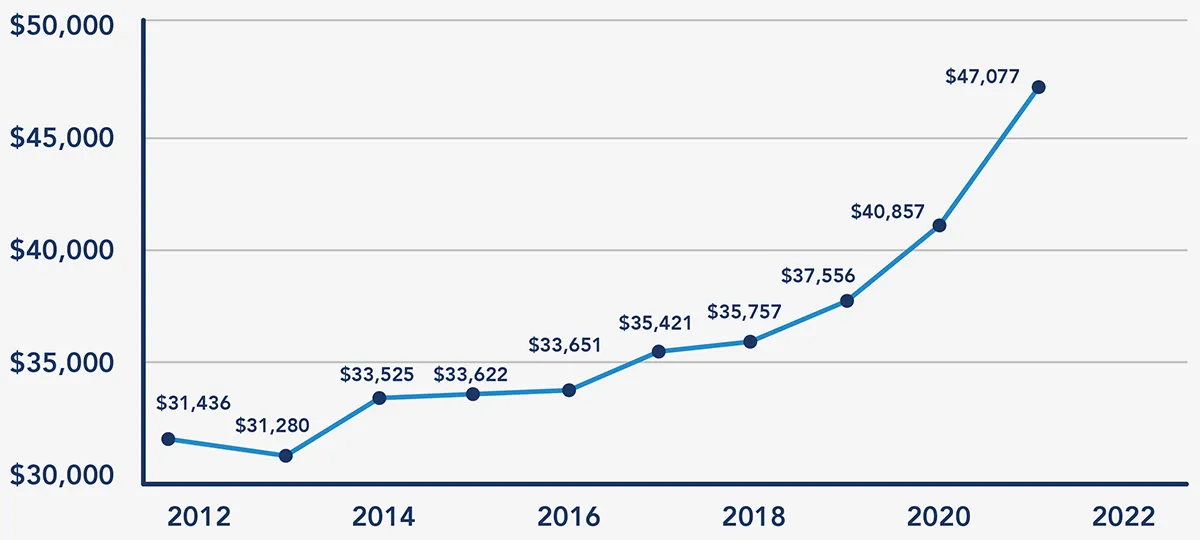

A recent example of this is the cost of new cars.

The price of new cars has skyrocketed over the past few years. Because of a worldwide microchip shortage, fewer cars are being produced. Demand hasn’t gone down, but the number of cars available has – therefore, the price of new cars has increased due to demand-pull inflation.

How is Inflation Measured?

Now that you have a pretty good idea of what causes inflation, let’s discuss how inflation is measured.

Consumer Price Index (CPI)

The first way we measure inflation is by looking at the Consumer Price Index. This looks at the weighted average of prices of a “basket” of consumer goods and services.

- Recreational Activities

- Education

- Haircuts

- Transportation

- Housing

- Food

- Funerals

- Medical Care

This “basket” is an actual economic term and represents consumers’ monthly spending habits. You can think of a “basket” as containing costs such as housing, food, transportation, medical care, recreational activities, education, haircuts and even funerals.

The reason we use a basket of goods is because different products and services are affected differently by inflation. By using a collection of different goods, we can create a weighted average of all different price increases.

Producer Price Index (PPI)

The Producer Price Index is similar to the Consumer Price Index but instead measures inflation from the perspective of the business (the producer) to create products and services for consumers to purchase.

Typically, if it costs the business more money to create the product you want to purchase, then it’s going to cost you more to own it.

Personal Consumption Expenditures Price Index (PCE)

The last metric we see when measuring inflation is the Personal Consumption Expenditures Price Index. Yes, this already sounds confusing enough so let’s just think of it as a way to figure out if people are buying stuff or not.

How Do Interest Rates Affect Inflation?

Almost all modern economies have a central bank that is tasked with influencing interest rates to control inflation and the cost of borrowing and lending throughout the economy.

The Federal Reserve has used interest rates to control inflation for the past century. When the Federal Reserve lowers interest rates, it causes consumers to spend more and businesses to hire more because money is much cheaper to borrow.

On the other hand, when the Federal Reserve raises rates, the opposite follows. For example, consumers will pay more to finance an auto loan or to get a mortgage when rates go up.

The bottom line is low rates encourage spending and higher rates slow spending and encourage saving.

Navigating Inflation as a Consumer

As a consumer, it’s important to keep a pulse on inflation trends so you can manage your finances accordingly. Here are some ways to navigate inflation as part of your money management.

- Monitor economic indicators: Stay informed about key economic indicators like the Consumer Price Index (CPI), Producer Price Index (PPI), and wage growth. These indicators can provide insights into inflation trends and help you anticipate price changes.

- Create and stick to a budget: Inflation can erode your purchasing power over time. Adjust your budget to account for potential price increases for the essential goods and services.

- Look for opportunities to save: Look for creative ways to save on fuel by carpooling, walking or riding a bike. Save on food costs by buying groceries in bulk or planning to make homecooked meals instead of eating out. Lowering your monthly costs will help you battle higher inflation.

- Diversify investments: Inflation can impact investment returns. Diversify your investment portfolio across asset classes such as stocks, bonds, real estate and commodities to mitigate inflationary risks.

- Consider inflation-indexed assets: Invest in assets that have intrinsic inflation protection, such as Treasury Inflation-Protected Securities (TIPS) or inflation-indexed annuities, which adjust for inflation over time.

- Debt management: Inflation can erode the real value of debt over time. If you have fixed-rate debts like mortgages or student loans, the real burden of repayment may decrease during periods of inflation.

- Stay flexible: Be prepared to adapt your financial strategy based on evolving economic conditions. Stay flexible in managing your finances to navigate inflationary pressures effectively.

Inflation can be a good thing because it’s a sign that the economy is doing well. However, if inflation is either too high or too low, the economy will suffer.

The just-right rate for inflation as determined by both policymakers and economists is right around 2% per year – which is also right around what we have experienced over the last 40 years until just recently.

You can protect yourself and your money from the effects of inflation by creating a plan for your money and looking for ways to save.