Address |

|

Branch Phone |

|

Member Care Center |

|

Services |

ATM |

Branch Lobby Hours |

Mon. & Fri. - 9:00 AM - 6:00 PM |

Today's Rates

Choice Rewards Credit Card

0%

12-Month Introductory APR1

on first 90 days of purchases

Branch Gallery

Local Awards

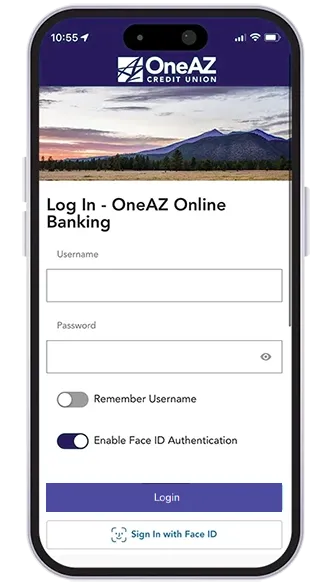

Do it all with the OneAZ Mobile Banking app.

![]()

Deposit checks

![]()

Transfer funds

![]()

Pay your bills

![]()

Chat with an associate

![]()

Locate an ATM