Do you ever look back in time and wonder why things were so much cheaper years ago? A loaf of bread cost six cents in 1914, gas was ten cents a gallon in 1939, an average house sold for $20,000 in 1964 and a new car cost just $12,000 in 1989.

So what happened, right?

The answer is inflation.

What is Inflation?

![]()

Inflation is the increase in the price of goods and services over time.

As you may have noticed, inflation leads to:

![]()

higher prices for goods and services.

Which results in:

lower purchasing power.

This is just a fancy way of saying your dollar doesn’t go as far today as it used to.

But why do prices continue to go up over time and what causes inflation?

Let’s start with the different types of inflation.

Cost-Push Inflation

The first type of inflation we see is called cost-push inflation.

This happens when the cost of goods and services to a business increases and therefore the business passes those higher costs onto their customers.

One of the most famous examples of cost-push inflation is the oil embargo of 1973.

During the oil embargo, OPEC stopped selling oil to the United States. This caused the price of fuel to skyrocket 400% and as a result, industries that relied on oil and gas were forced to raise their prices to stay afloat.

Average Cost for a Gallon of Gas

Although there isn’t another oil embargo happening today, the average cost for a gallon of gas has gone from $2.82 per gallon in March 2021 to $4.68 per gallon for March 2022. This 66% increase in gas prices not only is felt by you and me at the pump, but this increase in gas prices is also felt by businesses.

Another example we are currently seeing is with the cost of property increasing, thus causing rents and mortgages to go up, and therefore pushing prices up for consumers.

Demand-Pull Inflation

The more common type of inflation we see is called demand-pull inflation.

This happens when supply cannot keep up with an increase in the demand for a product or service.

A better way to think about it is this: more people want stuff and there isn’t enough stuff to go around so the price of whatever stuff is available goes up.

A recent example of this is the cost of new cars.

The price of new cars have skyrocketed over the past few years. Because of a worldwide microchip shortage, fewer cars are being produced. Demand hasn’t gone down, but the number of cars available has – therefore, the price of new cars has increased due to demand-pull inflation.

How is Inflation Measured?

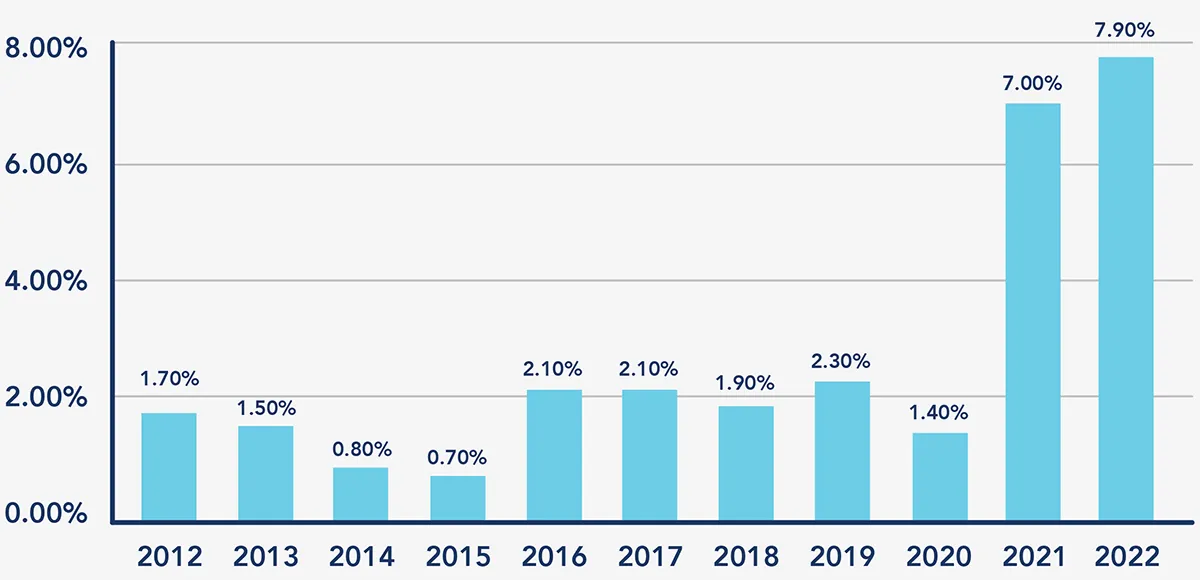

Now that you have a pretty good idea of what causes inflation, let’s discuss how inflation is measured. As you can see below, inflation remained steady for the past decade and then skyrocketed over the past two years to record levels.

But what do those percentages mean and how are they calculated?

Consumer Price Index (CPI)

The first way we measure inflation is by looking at the Consumer Price Index. This looks at the weighted average of prices of a “basket” of consumer goods and services.

This “basket” is an actual economic term and represents consumers’ monthly spending habits. You can think of a “basket” as containing costs such as housing, food, transportation, medical care, recreational activities, education, haircuts and even funerals.

The reason we use a basket of goods is because different products and services are affected differently by inflation. By using a collection of different goods, we can create a weighted average of all different price increases.

Producer Price Index (PPI)

The Producer Price Index is similar to the Consumer Price Index but instead measures inflation from the perspective of the business (the producer) to create products and services for consumers to purchase.

Typically, if it costs the business more money to create the product you want to purchase, then it’s going to cost you more to own it.

Personal Consumption Expenditures Price Index (PCE)

The last metric we see when measuring inflation is the Personal Consumption Expenditures Price Index. Yes, this already sounds confusing enough so let’s just think of it as a way to figure out if people are actually buying stuff or not.

What is Happening with Inflation Today?

As you have probably noticed, we are seeing inflation rates that we haven’t seen in 40 years . In fact economists will be studying the current inflation crisis for years to come to determine what happened, why it happened, and how to avoid it repeating itself.

But, what we do know is we have seen a combination of cost-push inflation, demand-pull inflation, and inflation as a result of more money being injected into the economy during the COVID-19 pandemic.

How Do Interest Rates Affect Inflation?

Almost all modern economies have a central bank that is tasked with influencing interest rates to control inflation and the cost of borrowing and lending throughout the economy.

The Federal Reserve has used interest rates to control inflation for the past century. When the Federal Reserve lowers interest rates, it causes consumers to spend more and businesses to hire more because money is much cheaper to borrow.

On the other hand, when the Federal Reserve raises rates, the opposite follows. For example, consumers will pay more to finance an auto loan or to get a mortgage when rates go up.

The bottom line is low rates encourage spending and higher rates slow spending and encourage saving.

Is Inflation Good or Bad?

The question of whether inflation is good or bad isn’t so black and white.

Inflation can actually be a good thing because it’s a sign that the economy is doing well.

However, if inflation is either too high or too low, the economy will suffer.

The just right rate for inflation as determined by both policymakers and economists is right around 2% per year — which is also right around what we have experienced over the last 40 years until just recently.

What Can I Do About Inflation?

Are you now feeling a little uneasy about all of this inflation talk? While our wallets are definitely feeling the sting of inflation, there are things you can do to protect yourself.

1. Do Not Panic

Instead, accept that inflation is here right now and take a deep breath. History has taught us that period of inflation won’t last a lifetime. Establishing and sticking to smart spending habits can help you weather inflationary periods.

2. Create and Stick to a Budget

Whether there is 2% inflation or 7.9% inflation, you still need to have a plan for every dollar in your life. Creating a budget which tells every dollar what to do before you actually spend it is a necessity when battling inflation.

Also, you may notice the prices of things going up which means it’s also time to adjust your budget to make sure the money you bring in each month is equal to the money going out.

3. Save Money

A silver lining to inflation is that it may give you an opportunity to take a look at your spending and to find opportunities to save.

Look for creative ways to save on fuel by carpooling, walking or riding a bike. Or, save on food costs by buying groceries in bulk or planning to make homecooked meals instead of eating out.

Whatever it is you can do to save money, lowering your monthly costs will help you battle higher inflation.

Summary

The good news is inflation is nothing new and has always been here. The bad news inflation is just higher than it normally is right now. However, you can protect yourself and your money from the effects of inflation by creating a plan for you money and looking for ways to save.

Chris “Peach” Petrie is the founder of Money Peach. Money Peach partnered with OneAZ to provide free financial education to members across the state. To learn more about OneAZ’s partnership with Money Peach, click here.

APR = Annual Percentage Rate