Dream car, meet dream rates.

Whether you’ll be zooming around the saguaro-dotted deserts of the south or the tree-lined mountains of the north, OneAZ Credit Union can put you in the driver’s seat.

-

New Auto - rates as low as 4.94% APR1 for 48 months

-

New Auto - rates as low as 5.14% APR1 for 60 months

No payment for the first 90 days of your loan2

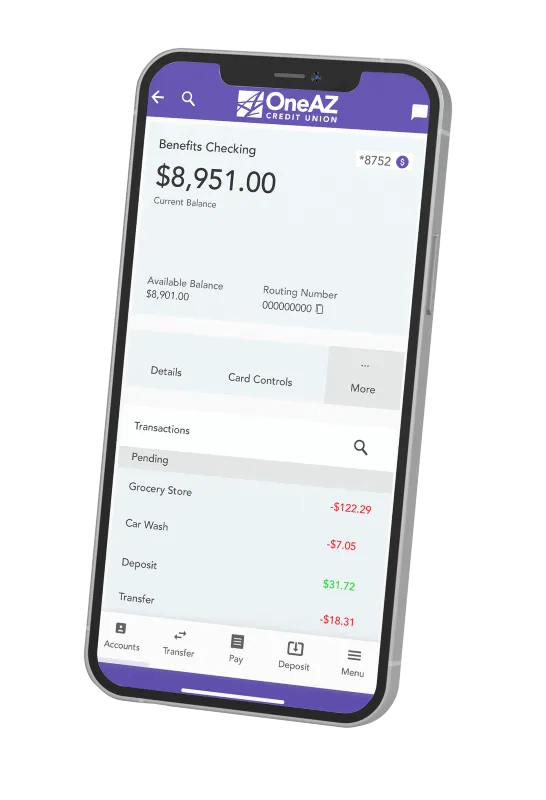

- Rates include a 0.25% discount for having a Benefits Checking account

Finance your Model 3, Model S, Model Y or Model X

When it comes to buying a Tesla, you know what you want. You’ve done your research and picked your model. Don't let a rate get in the way! Pair your sleek new car with the perfect low-rate auto loan from OneAZ Credit Union. Unlike other financial institutions, your Tesla car loan rate will not vary by model. All Tesla models qualify for our same OneAZ low rates.

Apply anytime.

We're here for you 24/7. Apply by phone after hours and on weekends.

Ready to roll?

Start your prequalification for a OneAZ auto loan:

Rates as of July 1, 2025.

1 APR = Annual Percentage Rate. New Auto Loans are 2024 and newer vehicles, in which the equitable or legal title has not been transferred to an ultimate purchaser. Term of up to 48 months; with an APR of 4.94 % and estimated monthly payment of $23.00 per $1,000.00 borrowed. Term of up to 60 months; with an APR of 5.14 % and estimated monthly payment of $18.94 per $1,000.00 borrowed. Other finance options available. Taxes and fees are not included. The rate may vary depending on each individuals’ credit qualifications, loan term and collateral. Loans through dealers do not qualify for promotional rate. Rates include a 0.25% discount for having a Benefits Checking account. Visit our Checking page for more information. Membership qualifications apply. For membership eligibility, visit our Membership page.

1 90 Days No Payment option will extend your loan by three (3) months, and finance charges will accrue on unpaid principal. This offer does not apply to refinancing existing OneAZ loans, Credit Flex, or Indirect loans.