We offer loans for recreational vehicles, motorcycles and boats to help you explore in style.

Boats

From fishing to water skiing or a casual cruise on the lake, our boat loans give you the chance to get away and on to the open water.

- Rates as low as 7.44% APR 1. Click here for all rates.

- Available for boats and watercraft of any size.

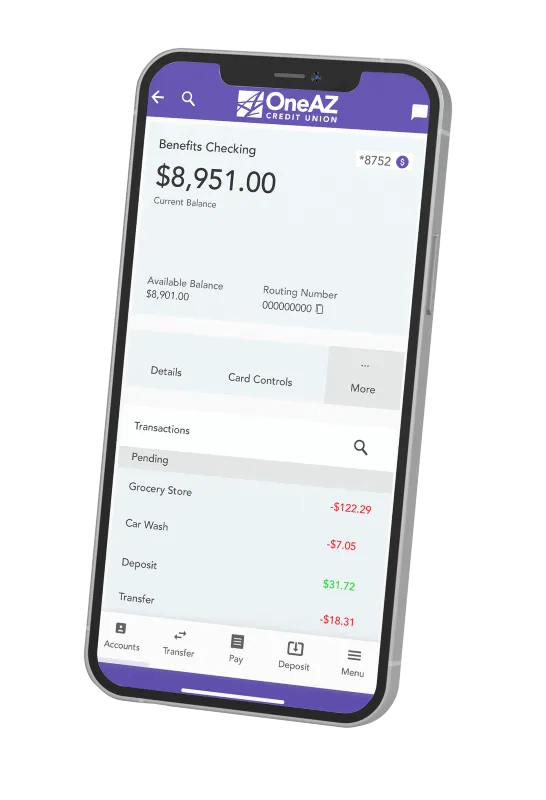

- Rates displayed include a 0.25% discount for having a Benefits Checking account

Recreational Vehicles

Exploring Arizona is about to get a lot easier! Our recreational vehicle loans allow you to purchase your home away from home.

- Rates as low as 7.44% APR1. Click here for all rates.

- Available for travel trailers, motor homes and more.

- Rates displayed include a 0.25% discount for having a Benefits Checking account

Motorcycles & More

Hit the open road with some of the lowest rates for motorcycles, ATVs, watercraft and more.

- Rates as low as 6.44% APR2. Click here for all rates.

- Available for motorcycles, dirt bikes, ATV's, jet skis and other watercraft.

- Rates displayed include a 0.25% discount for having a Benefits Checking account

Apply anytime.

We're here for you 24/7. Apply by phone after hours and on weekends.

Apply Online

Apply for a loan online today!

Apply by Phone

Call our Virtual Team today and get set up!

Schedule

Schedule an appointment at your local branch.

Auto Loan Calculator

Estimate your auto loan monthly payment with our online calculator.

Rates as of July 1, 2025.

1 APR = Annual Percentage Rate. New is any vehicle for which the equitable or legal title has not been previously transferred to an ultimate purchaser. Loan APR may range from 8.39% to 18.00% based on credit qualifications, income and collateral. Taxes and fees are not included. Other terms and conditions may apply. Loans through dealers do not qualify for promotional rate. Rates include a 0.25% discount for having a Benefits Checking account. Visit OneAZcu.com/checking for more information. Membership qualifications apply. For membership eligibility visit OneAZcu.com/Membership.

2 APR = Annual Percentage Rate. New is any vehicle for which the equitable or legal title has not been previously transferred to an ultimate purchaser. Loan APR may range from 7.39% to 18.00% based on credit qualifications and income. Taxes and fees are not included. Other terms and conditions may apply. Loans through dealers do not qualify for promotional rate. Rates include a 0.25% discount for having a Benefits Checking account. Visit OneAZcu.com/checking for more information. Membership qualifications apply. For membership eligibility visit OneAZcu.com/Membership.