Key Takeaways

- Prioritize paying off debt before saving money to build wealth.

- Always take advantage of your employer’s company match.

- One of the best ways to prepare for the high cost of health care during retirement is to utilize a health savings account (HSA).

If you’re part of Gen Z (those born between 1997 and 2012), you’re starting to leave school and enter the workforce. That means you're officially in the business of wealth building. In fact, from the time you get your first post-college or high school job until you enter retirement, building wealth will be a part of your life.

You and many Gen Z-ers out there may be wondering how much you should be saving or what type of retirement account to invest in. If you’re part of Gen Z and looking to get started building wealth, follow these 5 wealth-building steps to level up your saving and wealth-building game.

The Financial Landscape for Gen Z

What do finances look like for Gen Z? How does your generation differ from others when it comes to finances?

Gen Z is entering the workforce during a time of economic uncertainty and technological disruption. The aftermath of the global financial crisis, the rise of the gig economy, and the ongoing impact of the COVID-19 pandemic have shaped your generation’s financial environment. Despite these challenges, Gen Z is known for its adaptability and resourcefulness.

How is Gen Z doing financially in comparison to previous generations?

Gen Z faces a different economic landscape than previous generations. While they may have been initially disadvantaged by economic downturns and rising living costs, Gen Z is proving to be incredibly resilient. They are embracing unconventional career paths, leveraging technology to their advantage, and actively seeking financial independence at a young age. Studies suggest that Gen Z is more financially literate than previous generations, with a higher inclination towards saving and investing.

What are some key factors influencing Gen Z's financial decisions?

Gen Z's financial decisions are influenced by a variety of factors. Firstly, they are digital natives, comfortable with technology and digital platforms for managing their finances and investments. Secondly, they are socially conscious, prioritizing investments aligned with their values, such as socially responsible funds or sustainable ventures. Additionally, Gen Z values experiences over material possessions, leading them to prioritize experiences like travel or education over traditional markers of success.

How does the gig economy and remote work impact Gen Z's financial prospects?

The rise of the gig economy and remote work has presented both challenges and opportunities for Gen Z. On one hand, it offers flexibility and the opportunity to pursue multiple income streams through freelance work or side hustles. On the other hand, it can also lead to instability and unpredictable income. However, Gen Z's adaptability and entrepreneurial spirit have allowed many to thrive in this environment, leveraging technology to market their skills and services globally.

What role does financial education play in Gen Z's financial well-being?

Financial education plays a crucial role in empowering Gen Z to make informed financial decisions. With easy access to information online, Gen Z is actively seeking out resources to improve their financial literacy. They are more likely to engage in online courses, webinars, and social media content focused on personal finance, investments, and budgeting. This knowledge equips them with the tools to navigate the complex financial landscape and build a secure future.

5 Wealth Building Strategies Gen Z Should Adopt Now

- Start saving 15% of your income.

- Automate your savings and investing.

- Get the company match (free money).

- Open a Roth IRA or Roth 401k.

- Triple your tax savings with a Health Savings Account (HSA).

Gen Z, we hear that you’re hungry to get started building wealth and setting yourself up for financial success, and we want to help you get there. Follow these 5 strategies to get started.

1 Start saving 15% of your income.

Your first goal is to strive to save 15% of your gross income for retirement. When you start saving 15% of your gross income, you give yourself 40-plus years of wealth building. This will not only allow you to meet your retirement goal, but you’ll more than likely surpass your current financial goals by a longshot.

Example: Currently, the average annual income for Gen Z is $32,500. Saving 15% of that amount requires setting aside $407 each month for retirement savings.

Next, using the average annual rate of return from S&P 500 over the past 40 years, a 25-year-old entering the workforce would end up with $2.3 million in retirement by simply saving and investing 15% of their annual income.

Note: Average rate of return for the S&P 500 over the last 40 years is 10% and age at retirement is 65 years old.

Keep in mind, this is a low-end estimate since this scenario doesn’t account for raises and salary increases over the Gen Z worker's 40-year career!

But What If I Can’t Do 15%?

Investing 15% of your income may be easier said than done, especially if you’re trying to save while still paying off a student loan, a mortgage, or an auto loan.

If you’re facing debt, prioritize paying it off as quickly as possible. Your greatest wealth building tool is your income and too much of your income may be going out the door in the form of interest payments rather than building wealth for your future.

If you’re not currently living on a monthly budget, then it’s time to create one. Tell your money where to go instead of wondering where it went each month.

2 Automate your savings and investing.

Most companies offer a 401k or other retirement account, which makes it easy for you to start saving for your golden years. One of the best things about an employer’s defined contribution plan (401k, 403b, 457, TSP) is the ability to automate your savings directly from your paycheck.

When you start automating your retirement savings from your paycheck at an early age, you’ll quickly become used to living on less than you make. This in turn will result in continuous retirement savings over your entire working lifetime, which compounds over time and builds wealth.

However, if you’re a freelancer, part of the gig-economy, or don’t have a defined contribution plan through your current employer, you can still automate your retirement savings each month from your checking account.

This will require more discipline since the money you’re using to save for your future retirement is also sitting in your checking account right before it’s transferred over to your investment account. You will have to remain steadfast and fight the urge to buy more stuff with the money and instead send it to your IRA or Roth IRA.

3 Get the company match (free money).

Did you know that 98% of 401k plans have some sort of company match where employers will match up to a certain amount of whatever you save into your retirement account?

Yet, 17.5 million Americans did not take advantage of the company match from their 401k plan in 2021, according to CNBC. In other words, 17.5 million Americans did not take advantage of free money in 2021!

The company match is part of your total compensation package. Therefore, if you’re not taking part in the company match, then instead of getting free money, you’re giving your employer a raise!

Always take advantage of your employer’s company match. If you’re not sure how the company match works, contact your HR department to understand how much you need to save to get the full company match.

4 Open a Roth IRA or Roth 401k.

Tax-advantaged accounts like a 401k and a Roth 401k are either tax-deferred or tax-exempt.

Tax-deferred accounts such as a 401k, 403b, 457f, TSP, or traditional IRA provide an upfront tax break. This can be in the form of paycheck contributions to your 401k which offer an immediate tax benefit because they’re taken out before taxes or through a tax deduction with a traditional IRA when you file your tax return.

Tax-deferred doesn’t mean you’ll never pay taxes; it just means you are pushing back the taxes on your savings to when you withdraw the money in retirement.

On the other hand, tax-exempt accounts including a Roth IRA or a Roth 401k, operate differently than a tax-deferred account.

Instead of making contributions before your money is taxed, these contributions are made with after-tax dollars. Since you’re not getting a tax break on the front end, the alternative is your investments will grow tax-free and be withdrawn tax-free in retirement as well. This is why Roth IRAs and Roth 401ks are considered tax-exempt.

To keep it simple, whenever you see the word Roth, remember you’re paying taxes now and not in retirement. However, if you don’t see “Roth,” then you’re making tax-deferred contributions now and will pay taxes later in retirement when you withdraw your money.

Why a Roth IRA or a Roth 401k?

One is not better than the other and it’s important to simply understand why there are the two options.

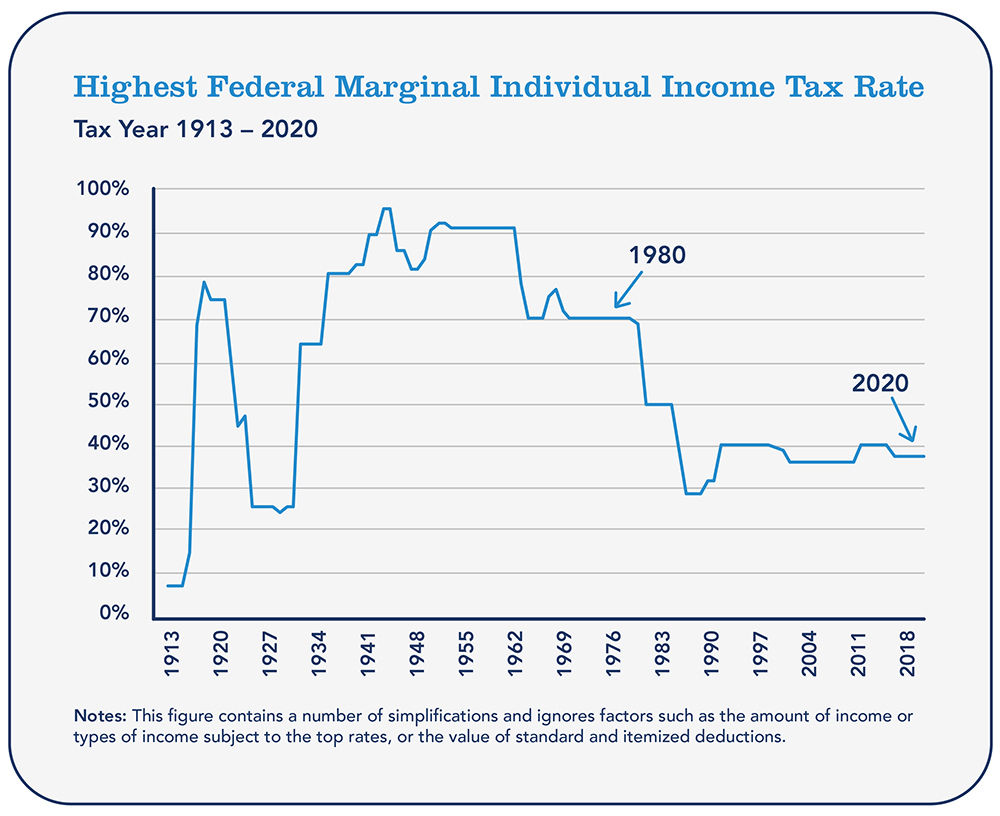

First off, it’s necessary to look back at history and understand the state of the economy in the early 1980s when the 401k gained popularity. According to TaxPolicyCenter.org, income tax rates in the late 1970s and early 1980s were much higher than they are today.

Photo Credit: Tax Policy Center

Therefore, workers were looking for strategies to avoid paying higher taxes during those higher tax bracket years and were waiting to pay lower taxes later in retirement when their income was less.

However, fast forward to today and the income tax rates look much different than they did 40 years ago. With that said, many workers are choosing to pay taxes today through a Roth IRA or Roth 401k to take advantage of tax-free withdrawals in retirement when income taxes could possibly go higher.

5 Triple your tax savings with a health savings account (HSA).

According to a report from Fidelity, an average retired couple age 65 will need $315,000 saved for healthcare expenses in 2022. As you can imagine, this amount could drastically increase by the time your generation enters retirement age.

One of the best ways to prepare for the high cost of health care during retirement is to utilize a health savings account (HSA).

Health savings accounts are unique because they offer the best of both worlds when it comes to a tax-advantaged account.

How Does a Health Savings Account Work?

Unlike a 401k or a Roth IRA, health savings accounts are both tax-deferred and tax-exempt when used for qualified medical expenses.

Tax-deferred

contributions

Similar to a 401k, the money you save into a health savings account is tax-deferred. If your employer offers an HSA, then you may have the option to save with tax-free contributions into an HSA just as you would with a 401k. If not, then the money contributed to your HSA will be tax-deductible when you file your tax return.

Tax-free

growth

You also have the option to take the savings inside your health savings account and invest it into stocks, bonds, mutual funds, or exchanged traded funds (ETFs). These investments also grow tax-free.

Tax-free

withdrawals

When using the savings inside your HSA for qualified medical expenses, your withdrawals are also tax-free. This functions very similarly to a Roth IRA or Roth 401k.

When used for medical expenses, you get triple tax-savings – meaning you never pay taxes on the money saved into an HSA.

If you’re employed, contact your employer and ask them if they have an HSA plan and if the employer contributes money toward the HSA on the employee’s behalf (free money)! If you’re self-employed, you can still open your own HSA on the open market.

Note: To qualify for a health savings account, you need to be covered under a high deductible health plan (HDHP).

Let’s invest in you.

Consult OneAZ Wealth Management to get started with investing or building your wealth plan.

More Wealth Building Tips

- Prioritize financial wellness and literacy: Gen Z places a high value on personal well-being, including financial wellness. To increase your financial stability, try to establish a budget, manage debt responsibly, and maintain an emergency fund. Prioritize mental and emotional well-being to ensure a holistic approach to wealth building.

- Don’t overcomplicate things: Too many people put off building wealth because they think it’s too difficult to understand or that it takes too much time. Keep it simple by getting started with your retirement savings either through paycheck deductions or using an IRA or Roth IRA if you’re self-employed.

- When choosing investments based on your employer sponsored plan, contact your employer sponsored provider for more information. Often your employer-sponsored investment company offers free webinars or teaching material to help you start.

- If you’re self-employed and need more assistance, find a trusted advisor in your area that is focused on teaching you how to get started instead of selling you on how to get started.

- Think long term: There will be times when it feels like your investments are going in the wrong direction, like the little bit you’re investing today won’t make much difference in the long run. When those fears start creeping in, remember that building wealth doesn’t happen overnight. Think long term and continually chip away at your wealth building goal over time.

Gen Z faces a dynamic financial landscape, marked by technological advancements, economic uncertainties, and changing career dynamics. By adopting these wealth-building strategies, you can build a solid foundation for long-term financial success.

APR = Annual Percentage Rate