How to Refinance an Auto Loan in Arizona

Apply in 5 minutes or less.

Getting pre-qualified is easy and free. Your savings journey starts by sharing a few details about yourself and your vehicle.

Apply online in as little as five minutes or call our virtual team.

Lock in your rate.

Once you're pre-approved, we'll walk you through the steps to complete your credit check and get you the best rate and term.

It's important to lock-in your auto rate as rates can rise at any time. Make sure to have proof of insurance on hand for this step.

You’re ready to go!

After you're pre-approved, we take care of loose ends with your current loan. You can schedule your first payment up to 90 days after closing.2

Get busy planning another adventure with your savings.

Current OneAZ Auto Loan Refinance Rates

Rates as low as

For 48 months

Rates as low as

For 48 months

for the first

Days

of your loan2

Why Choose OneAZ?

At OneAZ, our mission is to truly improve the lives of our members, our associates and the communities we serve. By becoming a member, you’re joining a credit union that cares about your future – we are here to help you achieve your financial goals. We put you first by providing you with competitive rates, low fees and the personalized service you deserve.

Competitive refinance rates as low as 5.19% APR¹ - among the best auto loan rates in Arizona.

Make no payments for the first 90 days², giving you breathing room from day one.

Choose the payment plan that fits your budget, with loan amounts up to $100,000.

Pay off your loan early anytime without extra costs or penalties.

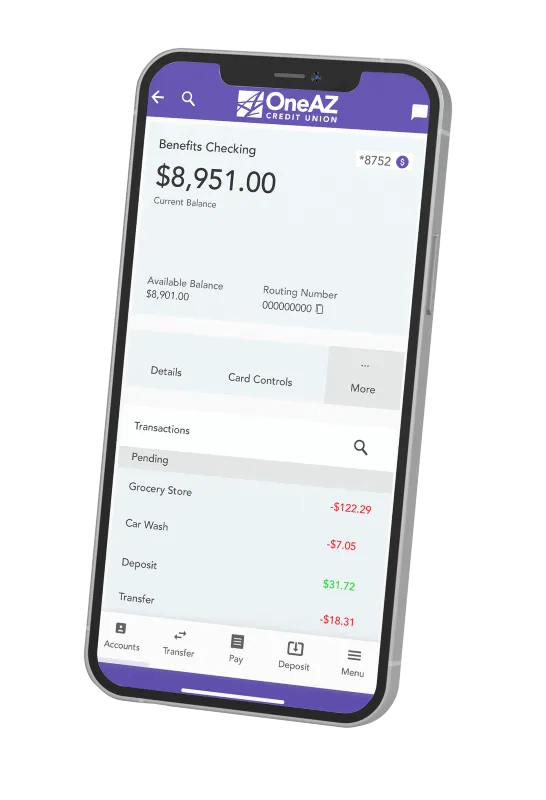

Get approved in minutes, manage your loan, and even close - all from your phone or computer.

Extended warranties and GAP coverage options available for added peace of mind.

Apply Anytime

We're here for you 24/7. Apply by phone after hours and on weekends.

Click

Apply for a loan online!

Call

Call our team and get set up!

Schedule

Schedule an appointment with a loan officer.

Contact Us

Auto Loan FAQs

Qualification depends on factors like your credit score, current loan balance, and the age and value of your vehicle. Our team can review your situation and help you determine your eligibility.

OneAZ does not charge application fees for refinancing, but your current financer may have prepayment penalties. We’ll review all details with you before you commit.

When you apply to refinance your auto loan, OneAZ performs a soft credit inquiry initially to provide you with loan options, which does not affect your credit score. If you decide to move forward, a hard inquiry may be conducted for final approval, which could have a minor, temporary impact on your score.

The process is typically quick - most applications can be completed online, and approvals often occur within a few business days

Whether you’re in Phoenix, Tucson, Flagstaff, or Yuma, OneAZ helps members statewide refinance their auto loans.

Extended warranties and GAP coverage options available for added peace of mind.

Already Submitted an Application?

You can click the link below to check the status of your application.

Financial Resources

What Is a Cash-Out Auto Refi and Is It a Good Idea?

Cash-out auto refinancing means to take the equity you have in your vehicle and turn it into cash by refinancing your vehicle with a new auto loan.

Keep Reading3 Reasons to Refinance Your Auto Loan

Lenders may pay off your current loan and create a brand new loan for you with possibly a lower interest and even better terms.

Keep ReadingHow Does Refinancing a Car Work and Is It a Good Plan for Me?

How does refinancing a car work? Learn about when it’s a good idea to refinance, how refinancing a car works, and when you might want to avoid it.

Keep ReadingRates as of March 1, 2026.

1 APR = Annual Percentage Rate. New Auto Loans are 2024 and newer vehicles, in which the equitable or legal title has not been transferred to an ultimate purchaser. Term of up to 48 months; with an APR of 5.19% and estimated monthly payment of $23.12 per $1,000.00 borrowed. Term of up to 60 months; with an APR of 5.39% and estimated monthly payment of $19.06 per $1,000.00 borrowed. Other finance options available. Taxes and fees are not included. The rate may vary depending on each individuals’ credit qualifications, loan term and collateral. Loans through dealers do not qualify for promotional rate. Rates include a 0.25% discount for having a Benefits Checking account. Visit our Checking page for more information. Membership qualifications apply. For membership eligibility, visit our Membership page.

1 90 Days No Payment option will extend your loan by three (3) months, and finance charges will accrue on unpaid principal. This offer does not apply to refinancing existing OneAZ loans, Credit Flex, or Indirect loans.

1 APR = Annual Percentage Rate. Used vehicles must be 15 years old or less to qualify for a loan. Term of up to 48 months; with an APR of 5.19% and estimated monthly payment of $23.12 per $1,000.00 borrowed. Term of up to 60 months; with an APR of 5.39% and estimated monthly payment of $19.06 per $1,000.00 borrowed. Other finance options available. Taxes and fees are not included. The rate may vary depending on each individuals’ credit qualifications, loan term and collateral. Other terms and conditions may apply. Loans through dealers do not qualify for promotional rate. Rates include a 0.25% discount for having a Benefits Checking account. Visit our Checking page for more information. Membership qualifications apply. For membership eligibility, visit our Membership page.